[ad_1]

My morning Summer season prepare reads:

• The Artwork of Brief Promoting: Amongst all of the actions in finance, short-selling stays one of the misunderstood. To many, the observe of promoting one thing you don’t personal with the intention of shopping for it again later at a less expensive value seems…summary. Few baulk on the thought of shopping for low and promoting excessive, however reverse the chronology and it sows confusion. (Web Curiosity)

• A Bull or a Bear Market? It Doesn’t Matter. Shares nonetheless haven’t returned to their final peak, and our columnist is within the camp that claims this isn’t a bull market but. However he’s shopping for inventory anyway. (New York Instances)

• U.S. Allocators Grapple With the Dangers of Investing in China: “Whereas a tail occasion is distant, it’s extra seemingly than it was 5 years in the past,” says Scott Taylor, CIO of the Andrew W. Mellon Basis. (Institutional Investor)

• Overlook the Fed, and Concentrate on the Financial system: What issues for long-run returns is getting the route proper, and the Fed’s fine-tuning misses the purpose. (Wall Avenue Journal)

• Don’t Overlook Who Loses in Fed’s Quest to Soften Labor Market: Decrease-income staff are those who’ve come off the sidelines to fill many current openings, and can seemingly be the primary to undergo when jobs disappear. (Bloomberg)

• 9 issues to find out about shopping for a automotive on this horrible market: With excessive rates of interest, restricted choices, skyrocketing costs and scarce reductions, it’s a troublesome time to be available in the market for a automotive. However if you need or want one now, there are methods to navigate {the marketplace} and discover a automobile that meets your wants, even when it means adjusting your expectations. (Washington Submit) see additionally EV Makers Confront the ‘Nickel Pickle’ Giant quantities of the mineral are wanted for electrical automotive batteries, however getting it out of the bottom and refining it usually requires clearing rainforests and producing massive quantities of carbon. (Wall Avenue Journal)

• The Dangers of Storing Cash in Apps Like Venmo and Money App: The Client Monetary Safety Bureau is warning that the funds could also be in danger if the app’s father or mother firm runs into hassle. (New York Instances)

• Parrots Are Taking Over the World: Sensible, adaptable and loud, parrots are thriving in cities far exterior their native ranges (Scientific American)

• Tax Cuts Are Primarily Liable for the Rising Debt Ratio: With out the Bush and Trump tax cuts, debt as a proportion of the financial system can be declining completely. (Middle For American Progress)

• In an Age of Energy, Luis Arraez Is Hitting Singles—and Batting .400: Baseball’s analytics motion has usually downplayed the straightforward act of hitting a single to get on base. The Marlins’ Arraez is difficult the brand new considering in an old style manner. (Wall Avenue Journal)

Make sure you take a look at our Masters in Enterprise subsequent week with Peter Borish, founding companion at Tudor Investments, the place he was Director of Analysis for 10 years working immediately with Paul Tudor Jones. He has additionally been Chairman and CEO of Laptop Buying and selling Corp, and Chief Strategist for quant fund at Quad Group. Borish can also be a founding trustee of the Robin Hood Basis, shaped with Paul Tudor Jones in 1988.

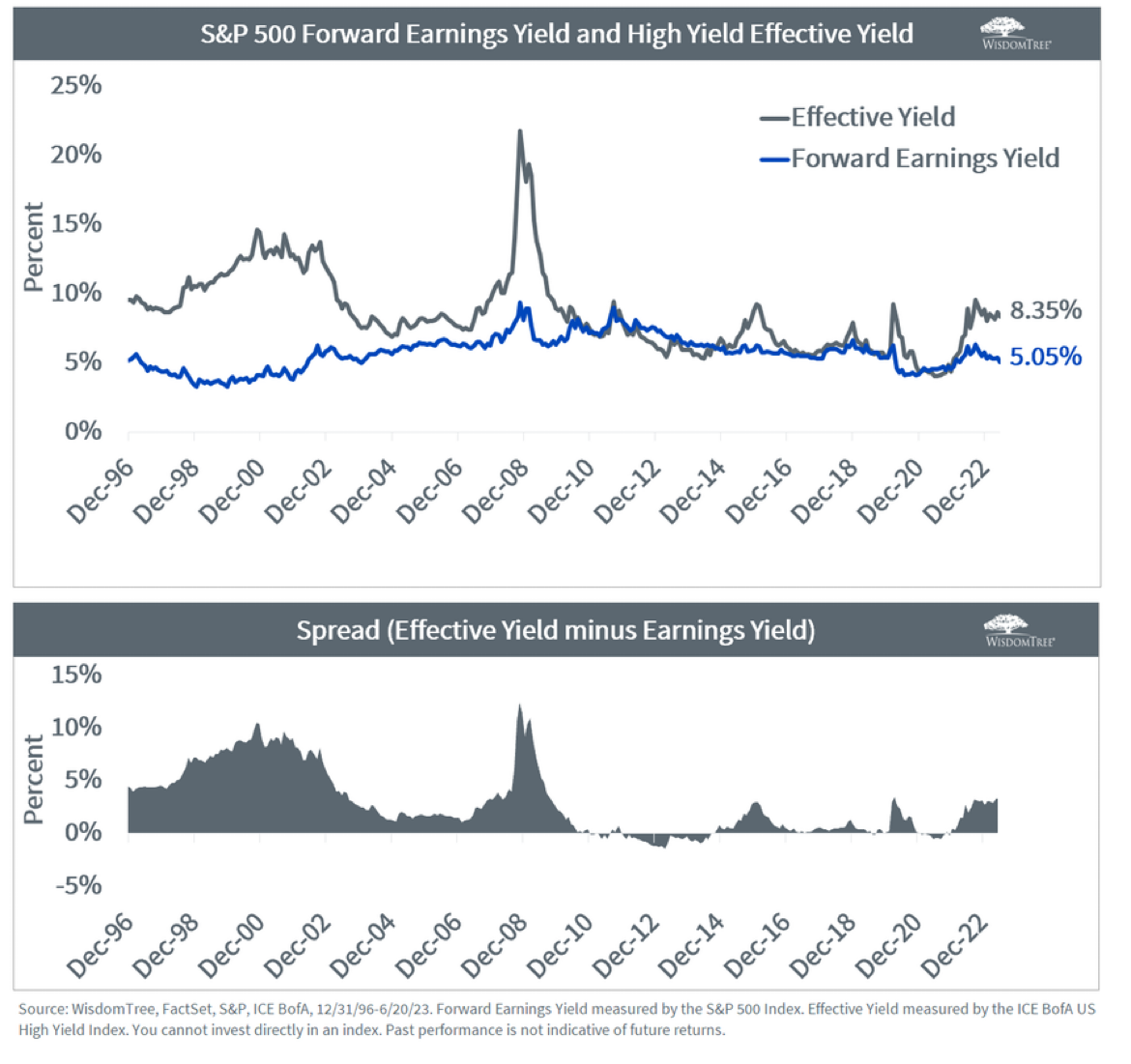

Evaluating Excessive Yield ranges vs Earnings Yields on the S&P 500; Median unfold over almost 3 many years is 170 bps Supply: @JeremyDSchwartz

Supply: @JeremyDSchwartz

Join our reads-only mailing record right here.

[ad_2]

Source link