[ad_1]

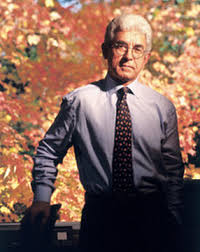

This 12 months, we misplaced certainly one of Wall Avenue’s brightest lights.

Starting in 1974, and over the following 50 years of investing, Laszlo Birinyi intently watched the markets. He was one of many market’s most insightful observers and served purchasers with nice distinction. He was a Fact-teller, particularly about how individuals allowed monetary Media to have an effect on their feelings, and was unusually frank about his fellow strategists and Wall Avenue salespeople.

Starting in 1974, and over the following 50 years of investing, Laszlo Birinyi intently watched the markets. He was one of many market’s most insightful observers and served purchasers with nice distinction. He was a Fact-teller, particularly about how individuals allowed monetary Media to have an effect on their feelings, and was unusually frank about his fellow strategists and Wall Avenue salespeople.

He grew to become recognized for his modern cash circulate evaluation, which in contrast inventory motion based mostly on buying and selling volumes at completely different value ranges.

Birinyi’s research of bull markets recognized 4 phases: Reluctance, Consolidation, Grudging Acceptance, and Exuberance. The ultimate part is marked by fearless conduct, a lot of newbies, and a rising probability of a crash. The contrarian conclusion was a lot of negativity amongst strategists was encouraging.

Over 50 years, Birinyi developed a collection of axioms:

Birinyi’s AxiomsCyrano’s Precept: Whether it is as apparent because the nostril in your face, the market additionally is aware of.

The bearish case is all the time extra compelling, and extra articulate, whereas the bullish argument is often concerning the future and the unknown.

Forecast environments, not occasions. Be bullish in a rising market and don’t deal with the main points.

Most indicators are descriptive, not indicative.

There may be nothing extra harmful than an articulate incompetent.

Predicting rain doesn’t depend; constructing arks or promoting umbrellas does.

You’re the solely decide of consultants.

Free recommendation just isn’t value it.

Investing actually is a occupation.

Beforehand:MiB: Laszlo Birinyi (September 13, 2014)

How Information Seems When Its Outdated (October 29, 2021)

[ad_2]

Source link