[ad_1]

Digital wealth providing permits prospects to commerce greater than 11,000 world and regional equities and ETFs throughout 21 capital markets

Clients can digitally open an funding account in simply two minutes by fully paperless journey and begin buying and selling immediately

Platform options one-of-its-kind device – Safe Signal – permitting prospects to digitally signal funding proposals to finish extra complicated trades

Zero commissions until December for ENBD X customers to mark Emirates NBD’s sixtieth anniversary celebrations

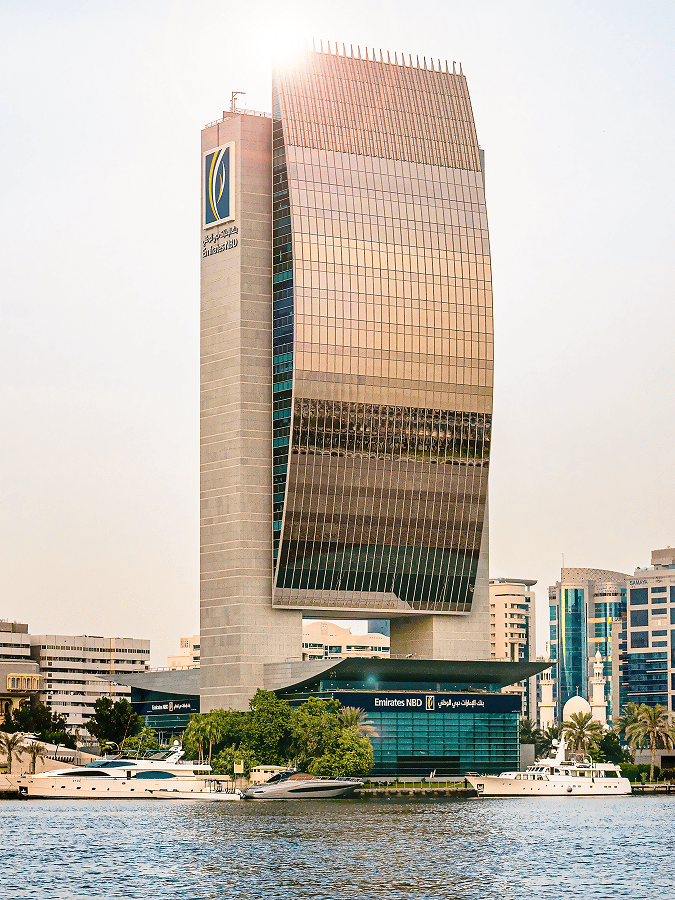

Emirates NBD, a number one banking group within the MENAT (Center East, North Africa and Türkiye) area, has launched a digital wealth platform that enables prospects to commerce securities and ETFs on each world exchanges comparable to, Nasdaq, NYSE, and London Inventory Change and native markets comparable to, Dubai Monetary Market, Abu Dhabi Securities Change, and Nasdaq Dubai. In all, there are greater than 11,000 world equities and 150 regional equities accessible to commerce on the platform.

The platform is embedded throughout the financial institution’s newly launched cell App ENBD X, permitting prospects to conveniently make investments and commerce in complicated monetary devices from the identical App that additionally fulfils all their on a regular basis banking wants.

As a part of Emirates NBD’s on-going sixtieth anniversary celebrations, the financial institution has launched an unique three-month digital wealth marketing campaign for ENBD X customers. Clients can make investments, purchase and/or promote on ENBD X with zero commissions for the months of October, November, and December 2023 with all relevant expenses to be refunded inside seven working days following every calendar month’s finish and custody charges waived off throughout the provide.

The brand new wealth platform gives an instantaneous onboarding journey to each present funding account holders in addition to new traders, involving three simple steps. New traders are despatched their account particulars on SMS and e-mail instantly and might begin buying and selling securities and ETFs immediately after including funds to their account by the platform’s Specific High-Up facility.

The platform additionally gives a novel Safe Signal facility, the place prospects with excessive buying and selling quantity can replace and signal funding paperwork to finish any commerce regardless of its complexity or worth. The device facilitates digital interactions between relationship managers and traders, eliminating the necessity to go to the department.

Along with the above, prospects also can use the platform to assessment market updates associated to their portfolios and see market movers of the day. It additionally gives funding instruments with historic and intraday charts together with technical evaluation, together with entry to unbiased analyst rankings and basic knowledge on market consensus.

Additional, for traders seeking to discover funding alternatives primarily based on nation, sectors, analyst consensus, dividend yield and different indicators, the platform gives entry to a Inventory and ETF screener. Clients also can create a number of watchlists to observe shares and ETFs and observe their favorite securities.

Marwan Hadi, Group Head, Retail Banking and Wealth Administration at Emirates NBD, stated: “The launch displays the financial institution’s mobile-first technique with almost 95% of the financial institution’s digital banking prospects availing providers by the cell banking App. With the launch of the digital wealth providing, we’ve got elevated ENBD X as a one-stop platform for each on a regular basis banking and wealth administration wants.”

Pedro Sousa Cardoso, Chief Digital Officer, Retail Banking and Wealth Administration, Emirates NBD, stated, “Our objective has all the time been to supply prospects a benchmark expertise with the widest vary of on-the-go digital banking providers, making their on a regular basis banking expertise as easy and handy as potential. Now we’ve got taken this to the following degree, by empowering prospects to handle their wealth and make investments immediately and securely by the ENBD X App, thus giving Emirates NBD prospects full management of their funds and their wealth in a single single platform.”

Just lately, Emirates NBD additionally accomplished the roll-out of ENBD X, an enhanced cell banking App designed in response to the most recent world design and consumer expertise requirements. Constructed with the most recent, most cutting-edge cloud applied sciences, the App gives an unrivalled mixture of lightning-fast efficiency, user-friendly journeys, top-level safety, and the most important array of services out there.

[ad_2]

Source link

![[Interview] Hits and misses of EU workplace and jobs legislation](https://thepublic.app/wp-content/uploads/https://media.euobserver.com/2a04fc2db5b581f0fa185a3c98b6a56a-800x.jpg)