[ad_1]

Zanyar’s dream of a life past his hometown Zurkan, close to Ranya, Iraq, price his household €11,000, his father’s land and, finally, price him his life.

Based on a neighborhood migrants’ affiliation, between 2020 and 2021 alone, over 56,000 individuals from the Kurdistan area of Iraq determined emigrate on account of geopolitical instability and lack of alternatives – 20-year-old Zanyar was certainly one of them.

“Zanyar dropped out of college,” Mustafa Mina Nabi, Zanyar’s father, recounts as he tended to the roses in his backyard outdoors his cement-made house in Zurkan. “He stated that others who graduated couldn’t discover a job both. And with no job, how was he going to cool down, get married, begin a household?”

Zanyar wished to succeed in the UK and set up himself as a barber. However his dream got here to an finish within the chilly English Channel, on a stormy day in late November 2021.

Zanyar was among the many two dozen individuals searching for refuge within the UK who died of hypothermia when their dinghy sank while attempting to cross from northern France to southern England. Reaching Europe and the UK by way of the irregular route shouldn’t be solely troublesome and harmful, but additionally extraordinarily costly.

The absence of authorized migratory routes has created enterprise alternatives for legal networks. It has additionally elevated the function of a casual banking system that works by means of “hawala”, a millenia-old conventional cash switch system primarily based on interpersonal belief.

This joint investigation, carried out over 2022 by a group of six journalists, exposes how tightening migration insurance policies have precipitated migrants to fall prey to unscrupulous smugglers, and belief hawala as the one method to mitigate the chance of being scammed.

Hawala: a system primarily based on belief

On a chilly morning in late November 2022, in Erbil’s Cash Exchangers Market, referred to as the “US {Dollars} Bazaar” within the capital of Iraqi Kurdistan, distributors transfer round with blocks of banknotes the dimensions of an old school TV field.

Males shout out giant sums of cash – US {dollars}, Iraqi dinars, Syrian kilos – which they provide to trade to the very best bidder. Cash always switches between palms.

Obtain the very best of European journalism straight to your inbox each Thursday

Dozens of money-order workplaces populate the streets, corridors, and basements of the bazaar. Some work with Iran, and others ship cash solely to Germany and France. Some have companions throughout Europe, whereas others declare they will ship cash to any nation on this planet. However, as a substitute of the standard channels of worldwide banking, many use the “hawala” system.

In Turkey, the hawala is commonly run by means of an trade cash workplace. In Greece, the hawala dealer could be the proprietor of a mini market or a store promoting cell phones. In Belgium, it could possibly be any of the three choices.

A hawala dealer’s workplace could be so simple as a desk and a chair, a cell phone, a cash counter machine, and a secure field. A pocket book additionally turns out to be useful to maintain observe of money owed.

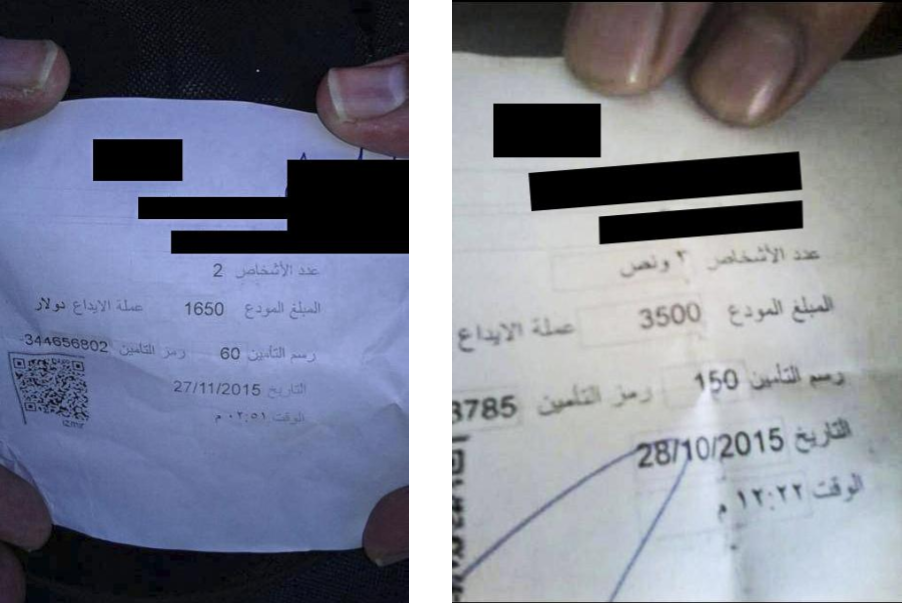

There isn’t a SWIFT or blockchain system to report transactions, nor do hawala brokers present any type of receipt that secures the debt. The system depends primarily on belief, Gözde Güran, an assistant professor at Georgetown College, explains. “By knitting collectively completely different belief relationships, hawala brokers are in a position to concurrently use the belief to ensure their mutual obligations and prolong their protection throughout a number of places.”

Within the case of smuggling, there’s a additional profit. To offer ensures of passage to individuals on the transfer, hawala brokers pay out the reserved sum to smugglers solely after they’ve efficiently reached their vacation spot.

A hawala dealer “wouldn’t wreck his popularity” by swindling a migrant, says Mustafa, Zanyar’s father: “Right here we’re from the old-fashioned. If he did one thing like that, nobody would do enterprise with him once more.”

In Zanyar’s case, the hawala dealer refused at hand the cash over to smugglers after his dying and as a substitute returned it to his household; small compensation for the lack of their beloved son.

The rising significance of hawala for migration

The system is as outdated because the Silk Street, when it was used to facilitate funds between retailers, stopping them from carrying giant sums of cash on their lengthy journeys.

Right this moment, cash transfers by means of hawala are significantly well-liked throughout the Center East and South Asia. For a lot of migrant communities, it’s also an ordinary system for sending remittances house, particularly to international locations like Iran and Afghanistan, excluded from the worldwide monetary system.

Whereas commissions of firms equivalent to Western Union or Moneygram can attain as much as 15%, hawala brokers cost wherever between 2% and 10%. Generally “it could possibly even be 0%”, explains a hawala dealer from Erbil, if the switch requested helps settle a debt in an handle the place not many shipments are often made.

The system can be not new to the fee of migration routes which, in keeping with estimates primarily based on information from UNHCR, Europol, the European border company Frontex, and professional stories, herald a collective annual turnover between €300 and €700 million.

Over one million individuals arrived in Europe in 2015, in what has been recorded as the height of the ‘refugee disaster’. Europol estimated that half had paid for his or her journey in money; the remaining by numerous strategies, together with hawala.

For a lot of migrants, that is the one reliable system to make funds because it supplies safety and prevents being cheated by smugglers or robbed by criminals or border guards. “No one carries massive sums of cash these days,” a intermediary who connects migrants and smugglers defined from his journey company within the heart of Ranya, in Iraqi Kurdistan. “It’s a service… The most effective one so [as to ensure that] at the very least individuals are not scammed.”

He was additionally on the transfer as soon as in 2005, when he traveled irregularly to Denmark and spent years there till he determined to return house. He then began to take part within the profitable enterprise of human smuggling.

The rise in pushbacks, throughout completely different border crossings of the journey, has made the hawala brokers’ insurance coverage function much more essential. Because it turns into tougher to cross borders, they promise to not pay out till a vacation spot is reached, which supplies important safety.

Most of them belong to the identical group because the individuals on the transfer, in keeping with professional Güran. “Prospects usually actually wish to go to the particular person from their nationality, even hometown if potential. They usually all the time specific a lot mistrust in the direction of brokers from different international locations,” she notes.

Generally hawala is known as a “shadow banking system”. However in keeping with Güran, that is dependent upon how authorities and authorized authorities view it. “I perceive that governments are anxious about unregistered people conducting cash transfers as a result of this doesn’t match into their surveillance safety paradigms of at the moment and they don’t seem to be in a position to hint these transfers, which may attain vital quantities,” she stated.

“Nevertheless in lots of contexts, it’s the solely system individuals know as a result of there is no such thing as a different method to pay suppliers or finance any type of operation,” she added.

The street begins on WhatsApp and Telegram

Smugglers use WhatsApp and Telegram to promote their companies and achieve the belief of individuals on the transfer. Over the course of this investigation, the reporters joined 13 Telegram teams the place smugglers join with migrants.

The teams present info on costs, particulars concerning the fee, and telephone numbers the place one can name for extra info. Messages are usually deleted inside a couple of days.

Directors referred repeatedly to “codes” and “decoding”; a reference to the passwords used to unlock cash at a hawala dealer when a checkpoint alongside the journey is reached. One smuggler promised: “Now we have a method to Serbia by means of Bulgaria. 5 hours stroll to the charging level […] In case of fingerprinting in Sofia, code decoding XXXX.”

The place is the cash?

As soon as acquired by smugglers and hawala brokers, there is no such thing as a method to observe the cash, making the system helpful to cover illicit income from authorities.

Alaa Qasim Rahima, referred to as “Abu Al Axe”, a Kurd born in Iraq in 1984, is aware of it effectively. When he was dwelling in a refugee camp within the Netherlands, Abu Al Axe used to promote meals in a “black market”. In a while, he moved to Italy and began to work as a smuggler: he may make preparations for individuals to cross the Balkans or Italy to succeed in France, Germany, or different locations by merely utilizing his smartphone.

Now, as he sits detained in an Italian jail, standing trial for allegedly smuggling migrants from southern Italy to the remainder of Europe, investigators haven’t been in a position to put their palms on his “treasure”.

“For every migrant, I requested for round €500-€600. The sums had been deposited with companies in Turkey, the place they nonetheless are,” he defined, in November 2022, earlier than his trial. He claimed his cash in Turkey quantities to almost €300,000.

“Current police investigations have highlighted the essential function performed by [the agencies] in favoring unlawful immigration in the direction of the international locations of the European Union. Not solely do they apply the so-called Sarafi (or hawala) technique, but additionally act as ‘companies’ for the recruitment of migrants keen to succeed in Europe,” the Guardia di Finanza (the Italian legislation enforcement company coping with monetary crime and smuggling) writes in a report.

The investigators additionally underline one other side: “The proprietor of the companies chooses the very best organised and most dependable smuggler” as a result of “solely the profitable final result of the switch of migrants ensures the hawala dealer the gathering of the chances on the charges as a result of smugglers.”

Hawala’s obscure authorized standing

In reply to a parliamentary query on July 31, 2020, Valdis Dombrovskis, EU Govt Vice-President accountable for an Economic system that Works for Individuals, acknowledged: “Throughout the European Union, people who function hawala, like all operators offering fee companies, needs to be licensed fee establishments, appropriately registered and controlled.”

Within the EU the system is unlawful, however in some international locations, like Italy, purchasers aren’t penalized – however hawala brokers are. In others, just like the UK, some hawala brokers are registered and controlled, whereas others function out of sight of the legislation.

“We have to be cautious to not current the hawala as a legal exercise as a result of, in some international locations like Austria, it may be authorized when you register with the authorities. Not many do register although, they usually could not know concerning the requirement to register,” says Dr. Claire Healy, coordinator of the Observatory on Smuggling of Migrants, established by the UNODC, who’s engaged on analysis concerning the “abuse” of the hawala system by migrant smugglers. The researchers interviewed 113 hawala brokers in 30 international locations (in Asia, Africa, Europe, and North America).

In October 2022, the second day of the “largest assembly ever of prosecutors who focus on tackling migrant smuggling,”( as its organizers, the European Union Company for Felony Justice Cooperation outlined it), was devoted to the monetary streams behind migrant smuggling teams, together with “using the choice hawala.”

In a report, the Monetary Motion Job Drive (FATF) – the worldwide cash laundering and terrorist financing watchdog – factors out that hawala is “the most typical technique of transferring funds (usually money) generated from migrant smuggling,” including that this makes it “extraordinarily exhausting for Monetary Data Items and Legislation Enforcement Companies to carry out monetary evaluation and investigations.”

There are numerous causes. “Monetary flows are sometimes channeled by way of hawala, and most often from and to international locations with restricted capability or expertise in conducting cross-border monetary investigations,” the report states.

Furthermore, individuals arrested for smuggling equivalent to drivers “are additionally typically unable to supply any info.” Similar to within the case of Abu Al Axe, “funds that aren’t seized throughout investigation stay out of attain.”

Hawala brokers would be the bankers

On a chilly and damp January morning in 2023 in Grande-Synthe, a coastal suburb of the French metropolis Dunkirk, refugees look forward to an opportunity to cross the English Channel.

In a cluster of blue and white tents that line a railway line, Aisha* and her two little daughters huddle collectively round a fireplace close to the observe, attempting to maintain heat. She plans to cross the Channel quickly, hoping to affix her husband who has already utilized for asylum within the UK.

To this point the journey – from Iraq to Turkey on a vacationer visa, then by means of the Balkans, to Croatia, and France – has price €4,500 for the three of them. Aisha expects to spend one other €1,500-€2,000 to cross to the UK by boat. Her father paid for the journey by way of a hawala dealer in Iraq. “With each border I’ve crossed, I ship my father a WhatsApp message with my location and he alerts the Nosinga (a Kurdish phrase for the hawala dealer) in order that funds could be made to the smuggler,” she stated.

“I’m a journalist and fleeing as a result of I used to be being focused for my work again house,” she stated.“I couldn’t get a visa to return to Europe legally and have needed to search refuge by means of this harmful route the place the smugglers are ruthless.”

“Since we don’t have the choice to return legally and wish safety, hawala is what now we have to resort to,” says Goran, a 19-year-old Iraqi-Kurdish man who can be ready in Dunkirk.

A Kurdish man from Iran joins the dialog: “The EU ought to take motion to alter this by giving extra visas. Even when they tried to sort out hawala, individuals will nonetheless discover a method to cross.”

Whereas European and worldwide police authorities are attempting to know how the hawala system works with the intention to sort out smuggling, for the hundreds of individuals on the transfer making their manner throughout Europe, hawala’s legality is irrelevant. And as smuggling stays the one journey route, hawala brokers will probably be its bankers.

*Some names have been modified.

👉 Authentic article on Solomon

[ad_2]

Source link