[ad_1]

Obtain free Currencies updates

We’ll ship you a myFT Each day Digest e mail rounding up the newest Currencies information each morning.

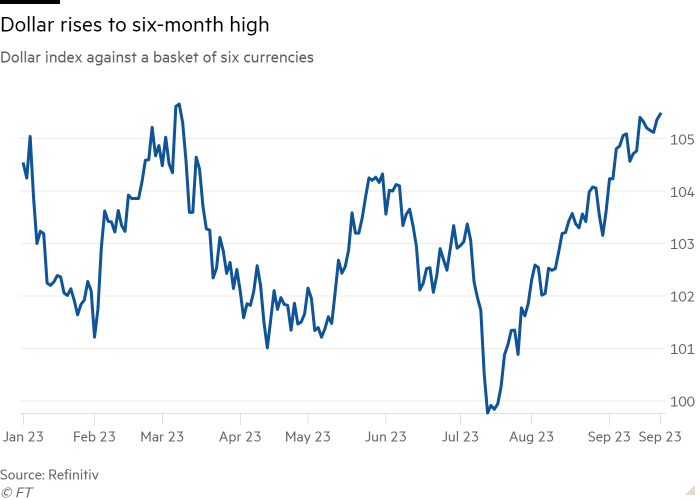

The greenback climbed to a six-month excessive on Friday on the finish of per week when US inventory and bond markets weakened and buyers ready for a chronic interval of excessive rates of interest.

The forex hit its highest ranges towards the euro, the pound and the yen since at the least March after the Federal Reserve set out plans to chop rates of interest — now at a 22-year excessive — rather more slowly than economists had thought.

US authorities bond costs fell, sending yields to their highest ranges in 16 years, whereas the S&P 500 benchmark index of blue-chip US shares suffered one in all its deepest weekly declines of the 12 months.

“Markets have taken the Federal Reserve fairly negatively,” stated James Briggs, a portfolio supervisor at Janus Henderson Traders. “Increased for longer is clearly entrenched and the conviction is that we’re in a brand new regime.”

The Fed’s determination to maintain charges on maintain this week and to sign its resolve to cut back them solely slowly all through subsequent 12 months and in 2025 was adopted by the Financial institution of England, which additionally burdened the significance of sustaining excessive charges.

The European Central Financial institution raised its personal benchmark charges to an all-time excessive this month.

Current slides in US and eurozone bond costs come after months of sell-offs in international fixed-income markets, largely due to larger benchmark rates of interest and better inflation.

Some market members warn the chilling impact of an prolonged interval of excessive rates of interest additionally makes fairness markets extra fragile, due to the influence of upper borrowing prices on the broader financial system.

“It’s an unstable scenario,” stated Joseph Davis, international chief economist at Vanguard, who argued inflation has traditionally often been vanquished at the price of decrease progress. “There have been hardly any examples ever of inflation coming down with hardly any trade-offs,” he stated.

Indicators the US is proving extra resilient than different main economies have helped the greenback climb 6 per cent towards a basket of different currencies since mid-July.

Jobless claims fell to their lowest stage since January this week whereas functions for unemployment help fell near an eight-month low.

“I feel the US is in a number one spot,” stated Robert Tipp, head of worldwide bonds for PGIM fastened revenue. He argued the markets had been lastly being satisfied that the Fed would maintain rates of interest excessive — partly as a result of the nation’s financial prospects are higher than elsewhere.

In its efforts to tame inflation that topped 9 per cent final 12 months, the Fed has elevated charges 5.25 proportion factors over 18 months — probably the most aggressive financial tightening cycles in its latest historical past.

“Traders had been dwelling sooner or later, pricing in cuts however markets acquired introduced spherical to the Fed as progress has been first rate,” Tipp stated.

Against this, ECB chief economist Philip Lane on Friday stated dangers to the area’s progress had been “tilted to the draw back”, with manufacturing exercise “set to stay weak” and “clear indicators of a slowdown” in companies.

The ECB has instructed it stays open to extra fee rises, however the intently watched buying managers’ index on Friday confirmed companies are reporting month-on-month falls in output and orders. The euro weakened following publication of the information.

Sterling additionally fell after UK PMIs confirmed weakening companies exercise, deepening the forex’s losses in per week when inflation fell quicker than anticipated and the BoE bucked expectations by declining to boost charges.

[ad_2]

Source link